Entry to the Philippines

To enter the Philippines, you need to fill out Arrival Card and Customs Baggage Declaration Form(CBDF).

Usually the card and form are issued on board the aircraft, and if not, you can take them at the counters in front of passport control. At international airports in the Philippines at passport control, as a rule, huge queues. Therefore, it makes sense to first take the forms, take a queue and fill them out already in the queue. After passing through passport control, you can collect your luggage at the tape, and proceed through the green or red customs corridor.

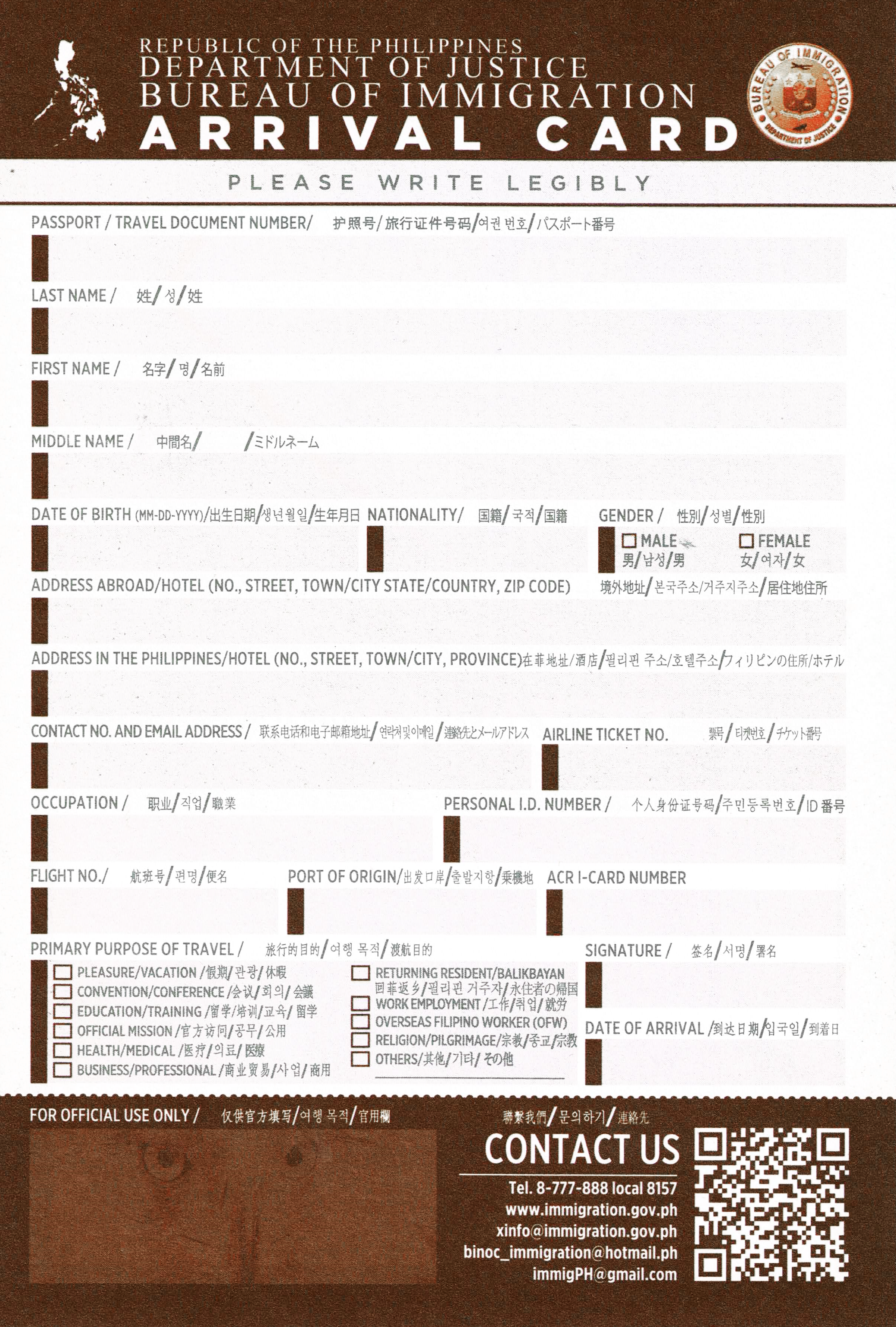

1. Bureau of Immigration(BI): Passenger Arrival Card

Travelers are asked to write their full name, nationality, passport number, contact number, flight/voyage number, purpose of trip, occupation, port of exit/destination, and their address here and abroad. Travelers are also required to sign and declare that the information written in the card is true, correct and complete.

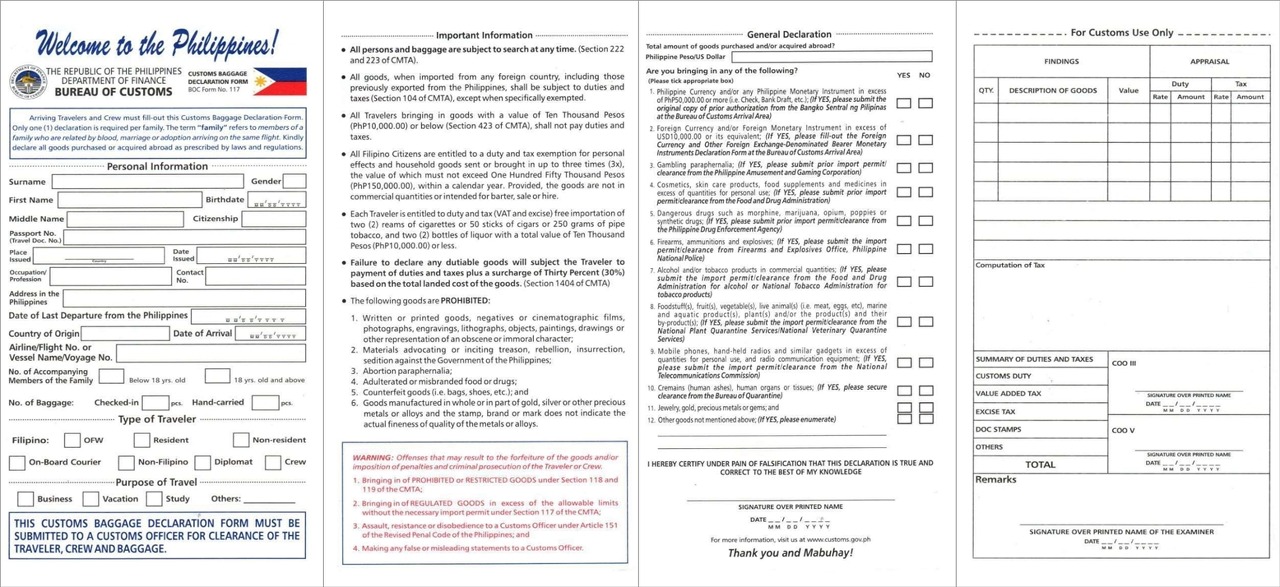

2. Bureau of Customs(BOC): Passenger Declaration Card

- All arriving passengers are required to accomplish a Customs Declaration from (BC Form 117) given on board the carrying aircraft.

- If traveling as one family, one declaration is sufficient. The term "family" refers to members of a family who are related by blood, marriage or adoption arriving on the same flight.

- All arriving travelers must accomplish a Customs Baggage Declaration Form(CBDF) which will be submitted to the assigned customs officer at the customs arrival area for clearance. Arriving passengers are required to declare all goods carried / bought, indicating the quantity and value.

Bureau of Customs(BOC) of the Philippines - PASSENGER GUIDELINES

1. Currency Regulations

The transportation of foreign currency or monetary instruments is legal. However, the carrying of foreign currency in excess of US$10,000.00 or its equivalent in other foreign currencies must be declared to a Customs Officer or the Bangko Sentral ng Pilipinas. It is illegal for any incoming or outgoing passenger to bring in or out Philippine Pesos in excess of P10,000.00 without prior authoirty from the Bangko Sentral ng Pilipinas. Any violation of this rule may lead to its seizure and civil penalties and / or criminal prosecution. (BSP Circular 98-1995)

2. All goods, when imported from any foreign country, including those previously exported from the Philippines, shall be subject to duties and taxes (Section 104 of CMTA), except when specifically exempted.

3. All Travelers bringing in goods with a value of Ten Thousand Pesos (PhP10,000.00) or below (Section 423 of CMTA), shall not pay duties and taxes.

3. Each Traveler is entitled to duty and tax (VAT and excise) free importation of two (2) reams of cigarettes or 50 sticks of cigars or 250 grams of pipe tobacco, and two (2) bottles of liquor with total value of Ten Thousand Pesos (PHP10,000.00) or less. (Adult Passengers)

4. Failure to declare any dutiable goods will subject the Traveler to payment of duties and taxes plus a surcharge of Thirty Percent (30%) based on the total landed cost of goods. (Section 1404 of CMTA)

5. The amount of duty to be paid shall be determined by the Customs Officer. Please have all your receipts and / or supporting documents ready for presentation to the Customs Officer.

3. Bureau of Quarantine: Passenger Health Card

One Health Pass

https://onehealthpass.com.ph/Registration/Step-1/

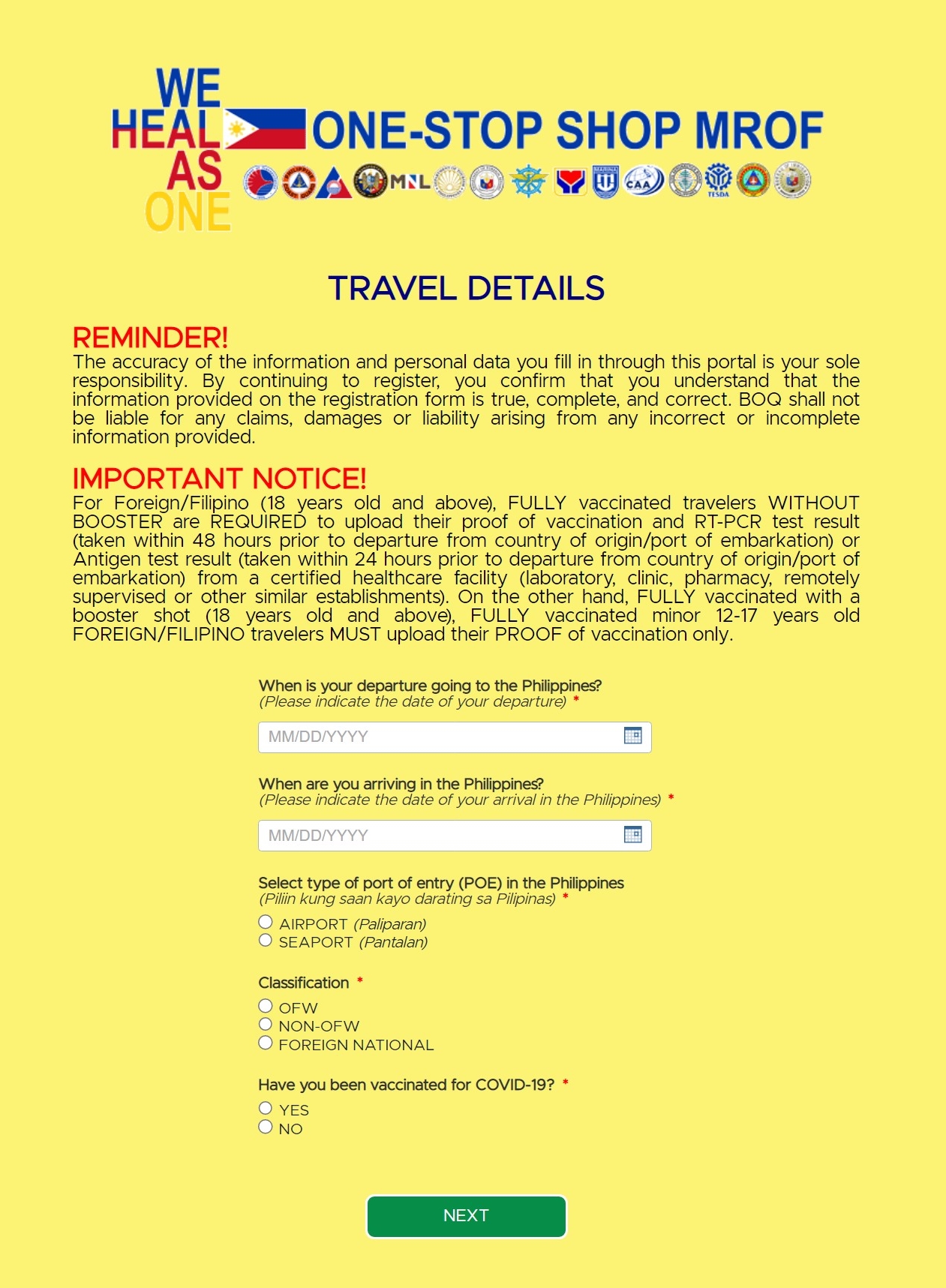

BOQ Health Declaration Registration

Ang kawastuhan ng impormasyon at personal na data na pinunan mo sa pamamagitan ng portal na ito ay iyong tanging responsibilidad. Sa pamamagitan ng pagpapatuloy na magparehistro, kumpirmahing nauunawaan mo na ang impormasyong ibinigay sa form ng pagpapareh

onehealthpass.com.ph

Philippines Arrival Card, Customs Baggage Declaration Form(CBDF)

- Copyright 2022. PHILINLOVE all rights reserved -

'필리핀 이민국' 카테고리의 다른 글

| [필리핀 이민국] 긴급여권으로 필리핀 입국이 어려운 이유 (1) | 2022.10.18 |

|---|---|

| [필리핀 입국] 마닐라공항 터미널1, 터미널2 ↔ 터미널3 환승 재개 (3) | 2022.09.28 |

| [필리핀 이민국] 노르만 판싱코 신임 이민국장 취임 (0) | 2022.09.20 |

댓글